The move to zero-emissions aircraft is seismic. We are looking at the new era in aviation, akin to the start of the jet age in the mid-twentieth century. Beyond the immediate technical challenges of aircraft propulsion design and integration, the whole aviation ecosystem will need to prepare and change to adopt new technologies. In this latest blog we explore hydrogen aviation for airlines & operators – everything from infrastructure requirements and operational considerations, to the opportunity of the production of green hydrogen.

- Operations with Hydrogen: Logistics, refuelling and maintenance considerations

- The Multi-Fuel Challenge: Managing the Transition

- Training for Safety: Emergency Procedures for Hydrogen-Powered Aircraft

- Reconnecting Regional Airports: How Hydrogen Aircraft Can Revive and Create New Networks

- Addressing Aircraft Performance and Payload with Hydrogen Technology

- The Economics of Hydrogen: Fuel Costs, Maintenance, and Operating Efficiency

Watch our Business Development Manager, Sam Lambert, talk through the topics covered in this blog

Hydrogen Aviation Operations: Logistics, Refuelling and Maintenance Considerations

Just as there are no regulations or standards currently in place for the use of hydrogen on an aircraft, there are no such regulations or standards that exist for its use in airport, airline or maintenance operations.

Airlines need certainty that airports, maintenance organisations and ground handling companies have the capability to handle their aircraft, but we cannot wait until hydrogen aircraft are ready for commercial service before we try to solve this problem. The good news is that operational trials involving hydrogen-powered ground service equipment (GSE) are already underway to help understand the risks and possible mitigations associated with using hydrogen as an aviation fuel in an operational airport.

A perfect example of this is Project Acorn, led by easyJet and Bristol Airport, where a successful trial was run to refuel a hydrogen fuel cell powered baggage truck in July 2024, using it to move about passenger bags from an easyJet commercial flight:

Building on this, CAeS is leading a piece of work within the Sustainable Aviation Test Environment (SATE) in Orkney, looking more specifically at the challenges of storing and handling hydrogen for aviation, and refuelling a passenger-carrying hydrogen aircraft in a commercial airport environment, which has additional challenges over and above the refuelling of GSE. This is a collaboration between CAeS, the CAA, EMEC, Loganair, HIAL, HITRANS and UHI with support from Cranfield University, BSI, HSE and Jacobs.

Further to the handling of and fuelling with hydrogen, there are the wider operational requirements at the airport that need to be established. For example:

- Safety zones: is there a minimum safety zone requirement for hydrogen aircraft, during refuelling and when parked?

- What training and qualifications are required for maintenance engineers to handle hydrogen-electric aircraft

- Should there be specific protocols around the hangaring of hydrogen aircraft and is there an implication for hangar design?

There is a lot to do but work is underway, for example, the UK CAA has launched the CAA Hydrogen Challenge and more recently three working groups, one of which is specifically designated to aerodromes.

The Multi-Fuel Challenge: Managing the Transition to Hydrogen Aviation

Decarbonising and transitioning to hydrogen aviation will not be as simple as replacing kerosene with one alternative fuel. There is no fuel currently available that is as versatile and ubiquitous as kerosene.

To put the challenge in perspective, the number of aircraft flying today is around 30,000 and between Airbus and Boeing, there is a backlog of orders for around 14,500 new aircraft. Even if all the aircraft were being produced at the rate of A320s (c.45/month), some of these new aircraft won’t be delivered for another 10-15 years.

And with current airframe lives being 30+ years, the transition to new fuels and new technologies will not be immediate for airlines, even as and when the technology is available.

That signals a long transition time, requiring both boldness and patience from operators and an additional challenge for airports who will need to ensure they can cater for aircraft requiring kerosene, SAF, battery charging and hydrogen. This will have an impact on stand design and availability which in turn may affect aircraft turnaround times and scheduling.

Training for Safety: Emergency Procedures for Hydrogen-Powered Aircraft

New Safety Protocols for Hydrogen Aviation

Hydrogen has different characteristics to kerosene which are well understood and that have been managed safely in industrial environments for decades.

The challenge for aviation is to understand how current industrial and automotive safety protocols can be adapted for use in an aviation environment where safety standards are exceptionally high. The control of aircraft fuel supply chains for example and the traceability and quality assurance demanded (mainly to avoid contaminants from entering the aircraft engines) is onerous and not always practical or suitable to be directly translated into procedures for hydrogen.

Emergency crews will need to be trained to handle an incident involving hydrogen, so they have the knowledge of how to approach and deal with the situation (just as emergency crews have had to be trained to deal with lithium battery fires since the introduction of the technology into mainly automotive applications). Firefighting and emergency services will also need access to and training on new equipment, for example infrared systems that can help spot a hydrogen flame, which is almost invisible to the human eye in daylight.

Reconnecting Regional Airports: How Hydrogen Aviation Can Revive and Create New Networks

Regional Airports and Declining Revenues

Regional airports across many parts of the world have seen declining air service and are underutilised. They are often seeing declining revenues as airlines have moved to concentrate services on larger airports, using larger aircraft with more seats upon which to spread the operating cost.

<Source: Global Market Overview report for CAeS, Mott MacDonald, July 2023>.

Hydrogen Aviation’s Potential to Revitalise Regional Connectivity

With lower projected operating costs, hydrogen aviation provides an opportunity to re-open regional connectivity and increase traffic to these locations, as demonstrated by the mission of our partner EVIA Aero. This will benefit local airports and provide opportunities for airlines to look at new networks.

When thinking ahead to the potential of increased regional connectivity, factors such as noise are a consideration. Airlines and airports are coming under increased pressure in many parts of the world to operate quieter aircraft, particularly at night. If we look at our first hydrogen propulsion platform, the Britten-Norman Islander, the hydrogen converted aircraft utilises an electric motor and we’re able to lower the tip speed, which will quieten the aircraft both for passengers and local communities. The first flight out and last flight in of the day are often the airline’s most important and being able to offer quieter aircraft presents an opportunity to extend lifeline services.

Addressing Aircraft Performance and Payload with Hydrogen Technology

Payload and Range Considerations

Airlines need to understand what a potential hydrogen aviation operation means for them and the differences compared with kerosene powered fleets and at CAeS we spend a lot of time working this through with our potential customers. As an example, the Hydrogen Fuel Cell System (HFCS) CAeS is developing is heavier than the engines it replaces, and gaseous hydrogen requires substantial, heavy storage tanks to keep it contained. The tanks limit the amount of hydrogen which can be carried and combined with the heavier technology, restrict aircraft range and payload.

Feasible Routes for Hydrogen Aircraft

Although the HFC Islander will have less range than its kerosene equivalent, it will still offer a range which covers the vast majority of operations the aircraft fulfils today. Future sub-regional routes are also feasible. According to research, 92% of the global sub-regional aircraft market could be covered by an aircraft with a range of 400km (by number of flights and seats operated).

<Source: Global Market Overview report for CAeS, Mott MacDonald, July 2023>.

Although the payload and range are the headline figures associated with any novel technology development today, there is much, much more to a flight route than simply distance from A to B. As propulsion system developers, it is essential that we understand the commercial realities of an airline operation. Diversion airports, fuel redundancy and IFR routings are just some of the essential requirements to understand and to ensure are borne into account atop basic flight planning if we are going to develop a commercially viable product. We continue to work closely with airlines to capture requirements on this and welcome more airline partners to help inform the product development process.

Payload, in this case being the number of passengers or amount of cargo that can be carried, is an important consideration for airlines that need to ensure profitable operations. The higher weight of the HFCS and tanks will have some impact on this, so it’s important that the operating economics are lower than the kerosene aircraft to allow for a profitable operation.

The Economics of Hydrogen Aviation: Fuel Costs, Maintenance, and Operating Efficiency

Initial capital expenditure and lower operating expenditure

Current aircraft engines, particularly for the small propeller sub-regional aircraft market in which zero-emissions solutions will first appear, have a long and proven service life. The costs, particularly for piston engines, are comparatively low. New technology often comes with a price premium, before the economies of scale and numerous product iterations have occurred. This is the case for the HFCS compared with the engines it replaces. Helping operators navigate this initial capital expenditure and realise the lower operating expenditure will be key and is a topic that will be covered in detail later in this series.

Retrofit vs. New Aircraft

Aircraft are generally older in the sub-regional aircraft market segment, with the global piston aircraft fleet at a median age of 41 years and small turboprop fleet at a median age of 30 years and offer lower capital expenditure at purchase; our plans to offer a retrofittable product are therefore attractive for keeping overall purchase prices as low as possible.

<Source: Global Market Overview report for CAeS, Mott MacDonald, July 2023>

Hydrogen Cost Predictions and Lower Fuel Consumption

If we consider fuel costs, the HFCS consumes less fuel than a kerosene engine. In our case the projections for fuel consumption for the HFCS is less than a third of the piston engine it replaces. Cost savings are predicated on the predicted cost of hydrogen of course but given the lower consumption rate, we find that the kerosene price can be a factor in the savings offered, especially for those aircraft using AvGas, such as the piston-powered Britten-Norman Islander.

Hydrogen Fuel Cell Systems Maintenance vs Conventional Combustion Engines

Further to fuel costs, maintenance is a fundamental metric for operating expenditure for airlines. Hydrogen fuel cell systems are less onerous to maintain, with no moving parts, and have much longer periods between overhaul compared with conventional combustion engines. It is not uncommon to see figures of 10,000 hours or more for HFCS applications in transportation; even taking a conservative approach given this is aerospace, the times are significantly longer than the combustion engines they replace

<source: https://www.ballard.com/markets/transit-bus>

Designing a Hydrogen Propulsion System that Meets the Performance Needs of Operators

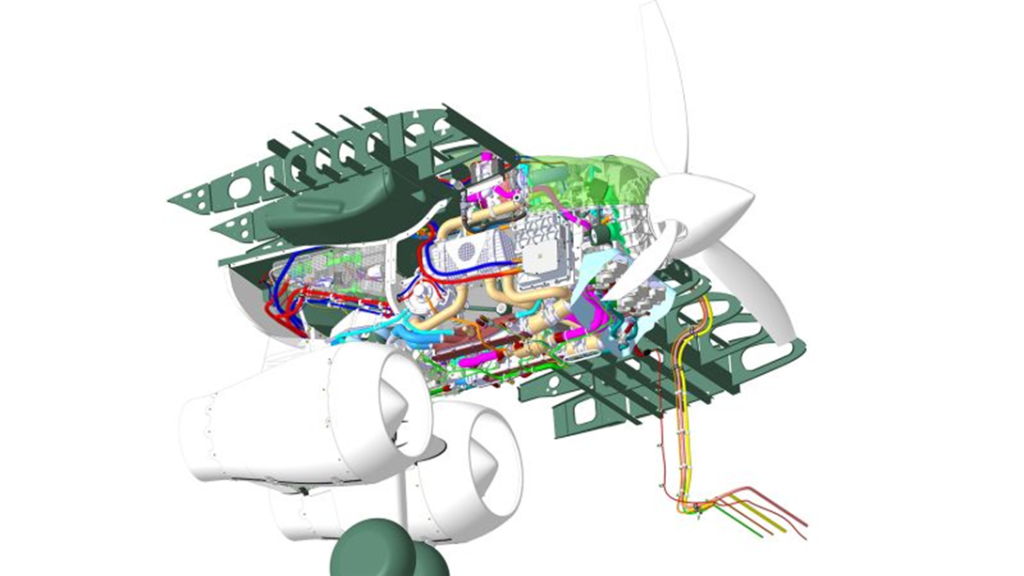

One of the main challenges of our strategy to begin with retrofitting a small aircraft is packaging the technology into a small space and having hydrogen and hazardous voltages side by side. Operators of the Britten-Norman Islander today particularly value its short take-off and landing performance. The exterior tanks will create additional drag and so it is essential that the aircraft has sufficient power to overcome this, with the aim to offer the performance of the piston-powered variant. Packaging the HFCS and electric propulsion unit (EPU) into the nacelle is key to reduce further drag implications as much as possible.

One noticeable feature of initial performance graphs from our fuel cell system partners is that it is less affected by temperature and pressure compared with a conventional combustion engine. Currently high temperature or pressure days can impede the performance of combustion engines, negatively impacting the take-off performance and resulting in airlines limiting the amount of payload they can carry where runway distances are limited. A HFCS has the potential to offer opportunities here for airlines to consistently maximise the available payload.

A final benefit of a hydrogen fuel cell propulsion system is its modular nature. It is much simpler to replace parts of the system than it is in a piston or turbine engine. This not only reduces maintenance costs, but it also presents the opportunity to relatively simply upgrade the technology over time without significant change to the rest of the system. This is important for two key reasons:

- It allows operators to benefit from the inevitable technology improvements that will be rolled out as further research & development makes it to commercial product

- It could help to reducing the impact of declining residual asset value

Conclusion: Hydrogen Aviation Presents an Impressive Opportunity for Airlines and Operators

In summary, it is important to acknowledge the size of the task ahead in adopting HFCS powered aircraft, to deliver zero-emissions aviation. Understanding the wider ecosystem and infrastructure, such as airport capabilities and energy production is important. For airlines, it’s essential to understand the differences a hydrogen fleet present, the challenges such as payload but also the opportunities in lower projected operating costs and a more consistent performance, less susceptible to atmospheric conditions such as temperature.